In 2017, I was supporting a client to develop a course in “Financial Intelligence” and since then, we’ve paused it because it’s WAY too complex. I’ve decided to develop a book on Financial Joy to teach some of my learnings from that project.

In 2017, I was supporting a client to develop a course in “Financial Intelligence” and since then, we’ve paused it because it’s WAY too complex. I’ve decided to develop a book on Financial Joy to teach some of my learnings from that project.

Financial Joy is someplace between financial literacy and financial intelligence. It’s a long way away from financial foolishness.

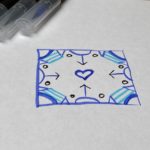

This visual represents a months cash flow and is intended to feel more like a floral wreath. We aren’t always taught how to manage our money and understand cash flow. It’s because so many of my clients have struggled with sales and clarity in finances, my imagination went to work.

Financial Joy begins with clarity and a playful approach to something we resist. Sales is a big theme with my clients and I often say there is data behind our dreams.

I’ve experimented with two different visuals. One focusing on a sales pipeline, number of appointments, and the results; and the other focusing on actual cash flow.

This is an expression of one month’s cash flow.

The inside of the circle represents days I spent money.

The outside represents days I earned money.

Often people tell me they hate spreadsheets and it’s not fun to look at the data. True! I can relate. Spreadsheets don’t show the full picture with my visual mind. It doesn’t show patterns in weeks when it’s all lined up. Using a circle made a little more sense to me.

This entire concept came about a year ago after my mother gave me an adult coloring book. I was picking colors for a beautiful flower while listening to a podcast from my sales coach. He was explaining that we all have a track to run on. Since I was a high jumper and ran the 400, my brain was searching for a circular visual representation of this sales ‘track to run on.’

I began to doodle different days and to sketch different concepts. In 2017 I tracked my data very closely. I would track every sales appointment, every estimate or proposal, every dollar I earned, and the average amount per transaction.

Your insights are requested!

You’ve received this blog post because I’m stuck on a few key points. My own data isn’t enough. I want to gather other experiences, insights, and lessons to make this book as powerful as I feel it can be. Thank you so very much for being open to spending a little time to get creative and be transparent with your sales/data situation.

I don’t like that we were often taught to not talk about money, but nobody told me we couldn’t draw & talk about the dollars. Please know I’m completely coming from a place of curiosity and service and not from judgment. I want you to feel great about your business numbers.

Dreams require sales skills!

Recently at LAF Tech, I’ve been ranting more and expressing my frustration. Since one of my rants and a method called “Sequence”, I came up with a representation of types of business owners I see.

- The Snail.

- The Ostrich.

- The Seagull

Check out the video above for a fuller description.

I’ve been all three of these at various points.

The snail is slow and steady. They often appear slimy because they are slow following up with people. They mean well but they just don’t follow up fast enough to make their clients truly happy.

The Ostrich is big and strong but often neglects to notice the details. Some might say they have their head in the sand.

The Seagull is flying confidently in the marketplace not afraid to say “Mine! Mine! Mine!” (Shoutout to Julie for teaching me this during our Financial Intelligence work) They are confidently capitalizing on their offers and promotions and their sales pipeline is full and abundance is common.

Don’t be the ostrich

This exercise, more than anything has helped me pull my head out of the sand (or the clouds!) and better respect the data in my own business.

I challenge you to do the same.

How do you create your own financial wreath?

- This part is pretty simple. Log into your business checking account and pick a 30-day window.

- You’re going to draw a big circle on a blank piece of paper.

- Create a key for yourself or borrow mine from above. They may be in $100 increments, $200, or $1000! I tend to see anything less than $100 as a leaf, and anything bigger as a flower.

- The 1st quadrant of the circle is week 1, the 2nd quad is week 2 and so on. Draw a little dot for the number of days in the month.

- Sketch each day based on what you spent or earned.

- Don’t be afraid if your 1st attempt is kinda messy. My 1st three were terrible! I’ve since hired a designer to help me bring the concept to a shareable place. You don’t have to make it pretty for this exercise.

- Notice the patterns. Notice your tendencies.

- I did 3 months and the patterns were not the same!

- I tend to be a snail when invoicing. I’ll be changing that.

- What do you notice?

- Talk with someone about this data. If you’re one of my early volunteers and are willing to experiment with me. Please book a complimentary call to discuss your learnings, doodles, and insights.

- This may be totally new and awkward for you and that’s ok!

- I’m hoping to find data from different industries.

- If you’re employed and have a steady paycheck, your wreath will look totally different than someone self-employed – and it’s still valuable to this project.

Develop Seagul Skills

For a 30 day time period, I want you to track your sales efforts (# of appointments/discovery sessions), estimates, and dollars in. I want you to say “Mine” every work day. Often in business, we can get so caught up in all the connecting, networking, and fun coffee dates.

In 2017, when I was tracking all my data super close, I noticed for 3 months in a row I didn’t actually ask anyone to purchase something from me. I was a connecting queen though! Lots of coffees, skype calls, and great hiking sessions but I wasn’t even asking my new connections to join a program or to sign a contract. Yes, sales is a skill and a sales processes is required.

I don’t have a visual to show for this just yet but I do have some data to share.

I realized after tracking my estimates super close in 12 months that the 3 months I quoted nothing, I earned less than $3,000 in revenue for those months. That income was from all previous contracts/clients.

I realize that if I can quote between $10K-$30K a month, I can easily bring in $4-$7K in revenue in those months. Sure, several people said NO, but some said yes!

I had begun to focus on saying “Mine” vs just being a friend. As businesswomen, it can be hard to know when to make an offer or proposal. I believe we need to truly identify a need before we can make a proposal. We have to listen from a place of service, and not just from a place of getting to know you. That was my mistake! Once I shifted back to selling as a form of service, my numbers began to feel like a dream come true again.

Take the Financial Joy challenge!

I don’t know your specific frustrations right now. I don’t know if you’re the snail, ostrich, or seagull. I’d love for you to get creative with this concept of a circular cash flow wreath. My friend Stacy Fisher Gunn says that part of self-care is financial self-care. Look at this exercise as a fun and relaxing way to honor your data.

Please take notes on your learnings.

If you’re totally confused and want a 15-minute getting started call, book that here.

Appreciate Your Progress!

Financial Joy is about appreciating the money coming in AND the money going out. So often we grumble when we pay a bill or receive an invoice and part of what I’m learning is that it’s a joy to have bills and to be surrounded by talent. I hope you find joy in the data and that this project can lead to profitable insights for you.